The UAE Central Bank introduces a new symbol for the dirham to boost its use in global markets

The Central Bank of the UAE (CBUAE) announced new symbols on Thursday for both the physical and digital dirham. This is part of a plan to make the currency more recognized in global markets.

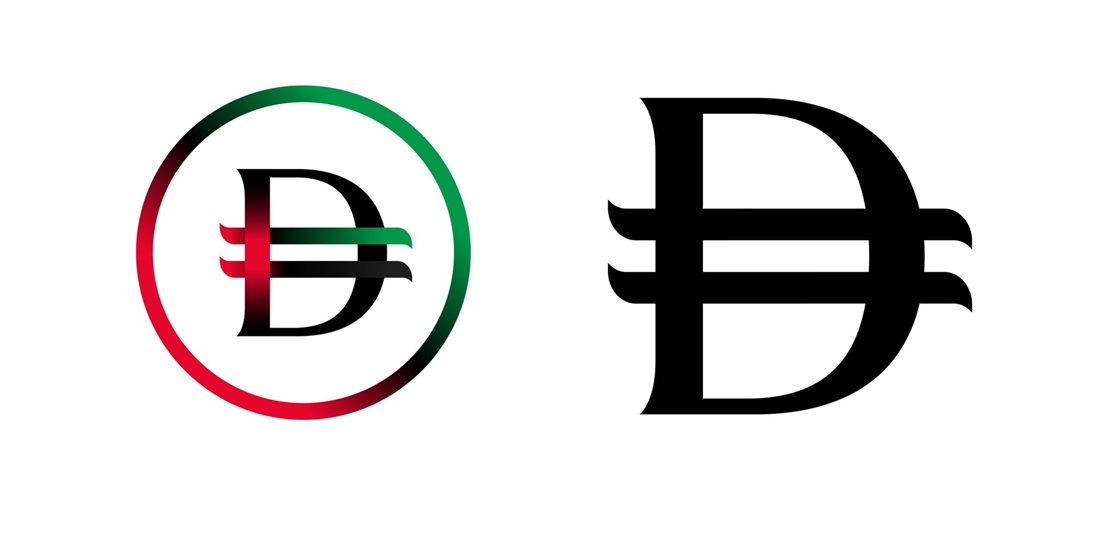

New Dirham Symbol

The new dirham symbol has two horizontal lines that stand for financial stability. It also represents the UAE flag over a capital letter “D,” according to the central bank. This change aims to strengthen the UAE’s position as a major financial center in the world.

The new symbol was introduced after the UAE’s central bank became the first in the Arab region to join the FX Global Code, a global financial standard.

The bank also shared updates on the digital dirham project, which is part of the Financial Infrastructure Transformation (FIT) Programme. This project focuses on improving the country’s financial system and digital banking services.

Digital Dirham and Legal Recognition

The UAE’s digital dirham is legally recognized under a new law (Federal Decree-Law No. 54 of 2023), which updates previous financial regulations. This law makes sure that the digital dirham is an official form of payment, just like physical cash, and can be used everywhere in the UAE.

Digital Version of the Dirham

The digital dirham is an electronic version of the UAE’s currency, designed for better security and faster transactions. It uses blockchain technology to reduce costs and improve safety, data protection, and transaction speed.

People and businesses will be able to access the digital dirham through banks, exchange houses, and financial technology companies. It is expected to be available for retail use by the end of 2025.

Some key features of the digital dirham include:

-

Tokenization – This helps more people access financial services and allows digital assets to be divided into smaller parts for easier trading.

-

Smart contracts – These allow automatic and instant processing of complex financial transactions.

The central bank has also set up a secure platform for managing the digital dirham. A special digital dirham wallet will allow users to make payments, send money, withdraw cash, top up their balance, and more. The system is designed to be easy to use and follows international financial standards.

Important Statement

“The digital dirham, powered by blockchain technology, will greatly improve financial stability, inclusion, and security while helping to prevent financial crimes,” said Khaled Mohamed Balama, the governor of the UAE central bank.

Published: 28th March 2025

For more article like this please follow our social media Facebook, Linkedin & Instagram

Also Read:

Egypt approves $91B budget to aid vulnerable, boost recovery

Emaar to pay $2.4B in 2024 dividends after shareholder vote

UAE’s Enza raises $6.75M to expand financial access in Africa