Delivery Hero is planning to launch Talabat Dubai on the stock market and reports strong growth in sales this quarter

Delivery Hero’s stock jumped more than 4.5% on Thursday after it announced plans to list its UAE subsidiary, Talabat, on the Dubai stock exchange by the end of 2024.

Talabat IPO

Delivery Hero, the German company behind Talabat, is planning to sell some of its shares in Talabat through an IPO (Initial Public Offering) on the Dubai Financial Market (DFM). Despite this, Delivery Hero will still keep majority control. The company hasn’t shared details about how much money it hopes to raise, who the investors might be, or how the funds will be used.

Both Delivery Hero and Talabat have said they will share updates about the IPO when necessary.

The IPO will only happen if market conditions are favorable and it gets approval from the Securities and Commodities Authority.

According to a Deutsche Bank report cited by Reuters, the IPO announcement was unexpected but is likely to be well-received by the market.

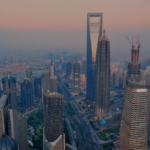

Talabat, founded in 2004, operates in several Middle Eastern countries, including Bahrain, Egypt, Iraq, Jordan, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

Delivery Hero’s Q2 Results Simplified

Delivery Hero shared its second-quarter financial results on Thursday and announced plans for a public stock offering (IPO). The company reported better-than-expected growth in total sales value (GMV) and confirmed its goals for the year, thanks to more customer orders.

In the second quarter, GMV grew by 7.4% (adjusted for currency changes) to $13.2 billion (€11.9 billion), beating analysts’ forecast of $12.8 billion.

The Middle East and North Africa (MENA) region showed the strongest growth, with GMV increasing by 28% compared to last year, excluding the effects of high inflation in Türkiye and Lebanon.

In Asia, which made up about one-third of Delivery Hero’s global sales last year, GMV dropped by 5%, as the company faced strong competition from rivals like Coupang and Yogiyo in South Korea.

Delivery Hero expects its GMV for the full year to grow by 7% to 9%.

Crucial quote

Marie-Anne Popp, the interim CFO of Delivery Hero, said: “Our strong growth continued in the second quarter of 2024. After adjusting for certain costs, we saw a rise in earnings of [$256.1 million] €231 million compared to last year. This helped us reach break-even in Free Cash Flow in the first half of 2024.”

Shares up

The company’s stock increased by 4.8% by 12:40 pm AST on Thursday, August 29, 2024, on the Frankfurt Stock Exchange, making the company’s total market value $7 billion.

Published: 28th November 2024

Also Read:

Breaking Free from Fear: Simple Ways to Deal with Rejection

Oil prices fall after Israel, Lebanon agree to ceasefire.

Solutions by STC secures $133M Islamic funding from Riyad Bank